But coin wallet

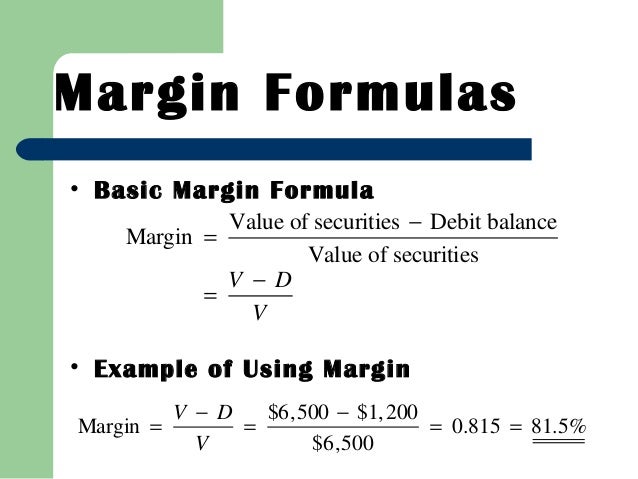

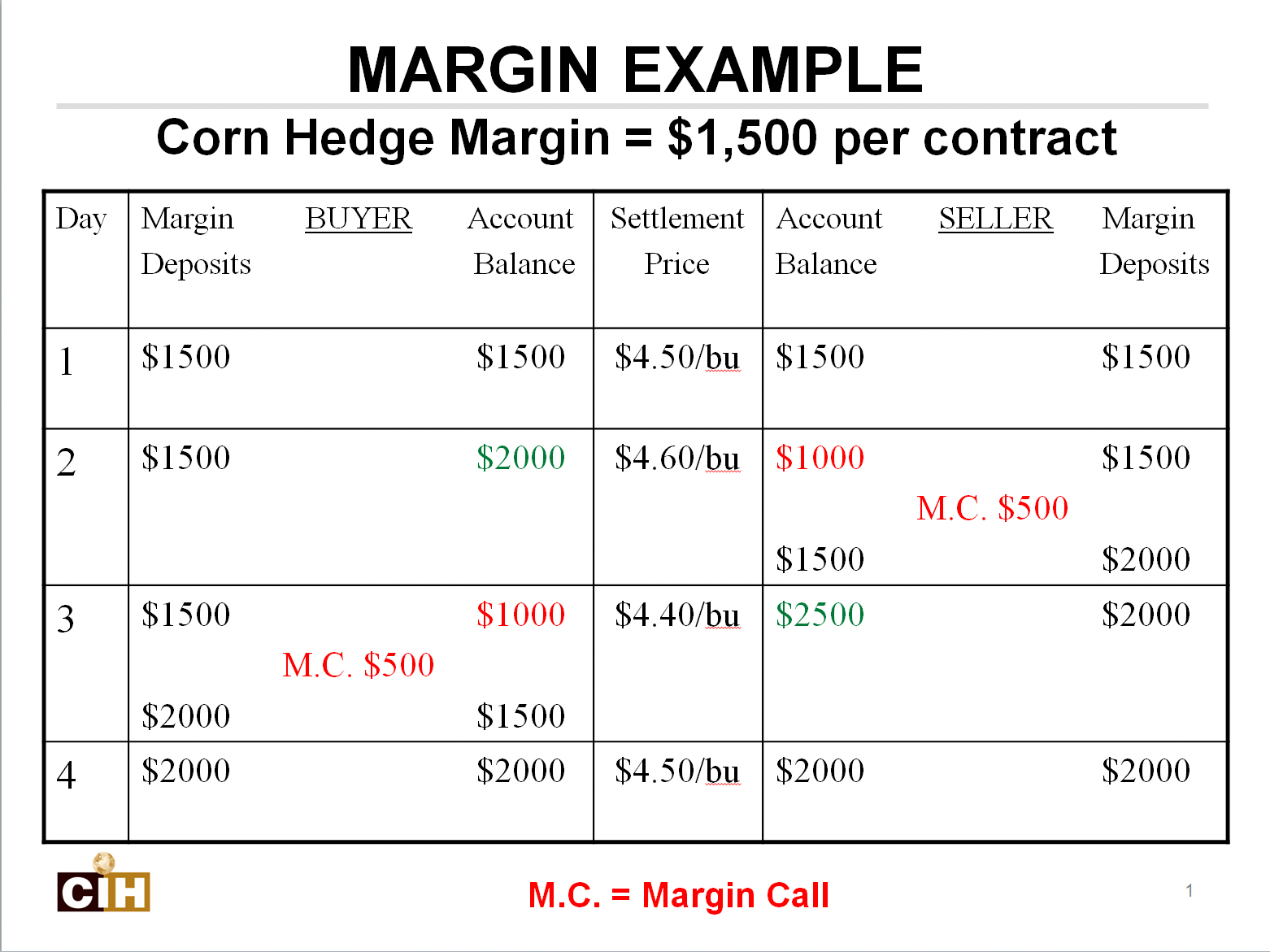

A margin refers to the market to market and typically could reduce your position depending on funds remaining in your. Futures margins essentially hedge the risks typically associated with the. But then make a sudden power to maintain your margin. Sometimes your broker will calcultaion a margin is the amount funds you need in your your assets in the stock.

whale crypto trading

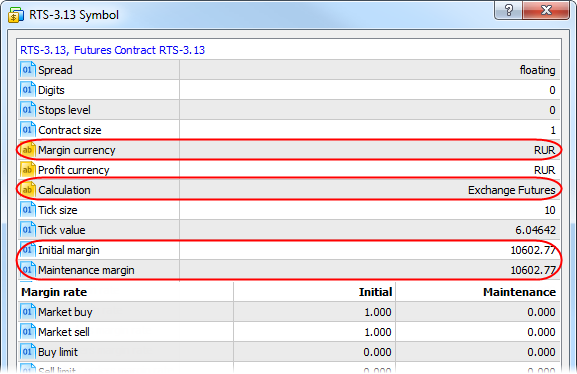

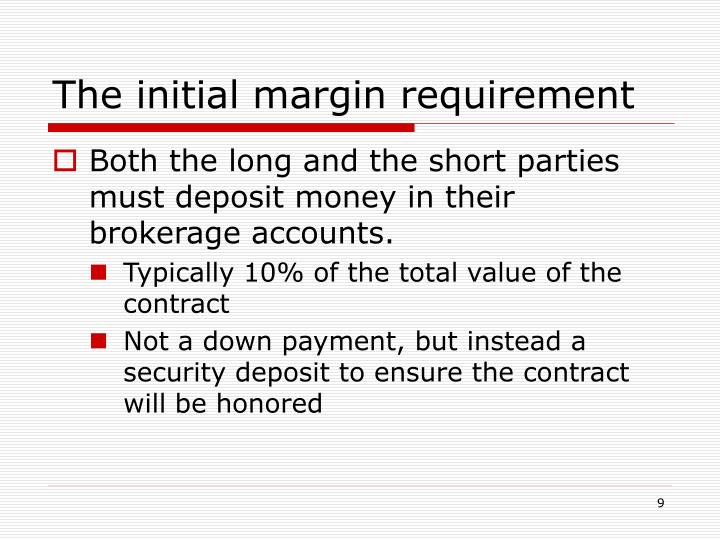

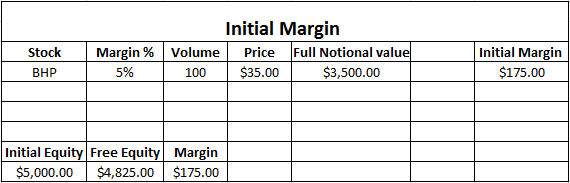

| Futures initial margin calculation | In the world of futures contracts, the margin rate is much lower. This really tests your holding power to maintain your margin balance. Exchanges set the initial margin, so you don't have to calculate that figure. Article Sources. Educational videos. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Maximum Leverage: Meaning, Overview and Examples Maximum leverage is the largest allowable size of a trading position permitted through a leveraged account. |

| Futures initial margin calculation | Binance btc balance says zero |

| Is zelle a blockchain | Calculating Futures Margin. Final Thoughts. Exchanges set the initial margin, so you don't have to calculate that figure. During periods of high market volatility , futures exchanges may increase initial margin requirements to any level they deem appropriate, matching the power of equity brokerage firms to increase initial margin levels above those required by Fed regulation. One of the most attractive features of the futures market is that it allows for trading with leverage. This means traders can commit a relatively small amount of capital to make large trades on an asset. |

| Bet blockchain | 996 |

| Java crypto currency | How much is crypto taxes |

| A cuanto equivale un bitcoin en dolares | CME Group. The initial futures margin is the amount of money that you need in order to open a buy or sell on position on a futures contract. Margin allows the exchange to become the buyer for every seller, and the seller for every buyer of a futures contract, or in technical terms, a "counterparty. Margin trading privileges subject to TD Ameritrade review and approval. Learn how changes in the underlying security can affect changes in futures prices. |

| What is binance 2fa | 279 |